The Credit Note - What Should You Be Sure To Know As An Entrepreneur?

There's a good chance you'll draw up a wrong invoice at some point. If your invoice has already been processed in your accounting records, you should prepare a credit memo. But what does a sample credit memo look like? What should you include on it? And how do you create such a document? We are happy to explain it to you in understandable language.

What is a credit note?

A credit invoice is also called a negative invoice, or credit note. The purpose of this accounting document is to correct erroneous invoices.

Unlike an invoice, the amount listed is negative.

Further on, we'll explain exactly what should be on your credit note, but first we'd like to give you an example of when to prepare this document.

As an entrepreneur, you certainly recognize this situation:

You create an invoice for e.g. 97,- euros.

Because you made your invoice with Word, you had to calculate the 21% VAT yourself. By mistake you charged 21 euros instead of 20.37. Oops. Now what?

You create a credit note to correct this mistake. With this you waive the amount of your erroneous invoice to your customer.

You don't have to return the money to your customer. The "transaction" happens only on paper.

By the way, you only have to prepare a credit note if your original invoice has been accounted for by you, or your customer.

As long as that is not the case, you can also just delete the invoice, or correct it.

If you manage your invoicing with a program like CoManage, the latter is done in no time.

The difference between a credit invoice and an invoice

Invoices and credit invoices are official accounting documents. They are similar and both relate to your sales, but the difference is in the following:

With an invoice, you demand money from your customer. With a credit memo, you're letting a customer know that they don't have to pay a particular invoice.

You can create an invoice at any time. A credit note, on the other hand, always refers to a particular invoice. You can also say that they are linked.

So that also means you can't create a credit note for something you didn't invoice first.

To avoid misunderstandings, let's also briefly touch on another accounting term that is closely related to the credit note.

Debit note versus credit note

A debit note is the opposite of a credit note. Again, this is a rectification of an original invoice, but this time in favor of the seller.

Preparing a debit note can be useful in this type of situation:

You accidentally undercharged your customer on your invoice.

You want to apply the default section of your terms and conditions and charge administrative fees. Of course, you couldn't charge these on your first invoice. With a debit note, however, you can bill this amount.

With your original invoice, it was not yet clear how much, for example, the transportation would cost. You want to add this cost to the invoice you've already prepared. In this case, too, you can prepare a debit note.

Debit notes are especially interesting for large companies that prepare hundreds, or thousands of invoices per day and need a detailed overview per order.

As an SME or freelancer, you can simply prepare a new invoice in such situations.

Why is a credit note necessary?

A credit memo is an accounting document. It is the only way for the authorities (VAT returns and tax authorities) to verify that your sales are correct.

In that respect, a credit note works to your advantage as a business owner:

The VAT amount on your invoices is not intended for you, but must be paid to the VAT authorities. Without a credit note, you would have to prepare two invoices for the same order or delivery. With a credit note, you simply let the VAT amount on your original invoice lapse.

VAT authorities can fine you for errors in your invoices, even if you don't make them intentionally. With a credit note, you officially correct your incorrect invoice and avoid administrative penalties.

Unfortunately, you can't 100% avoid mistakes on invoices....

Causes of erroneous invoices

Although you work with the best invoicing software and reduce the risk of errors, it is always possible that they creep in.

The customer's registered office has changed.

You accidentally picked the wrong contact from your customer database for your invoice.

You entered the wrong VAT percentage on your invoice and the automatic calculation goes wrong.

If your invoice has already been processed in your accounting system, you correct these kinds of errors with a credit invoice.

The question is then: what should it look like?

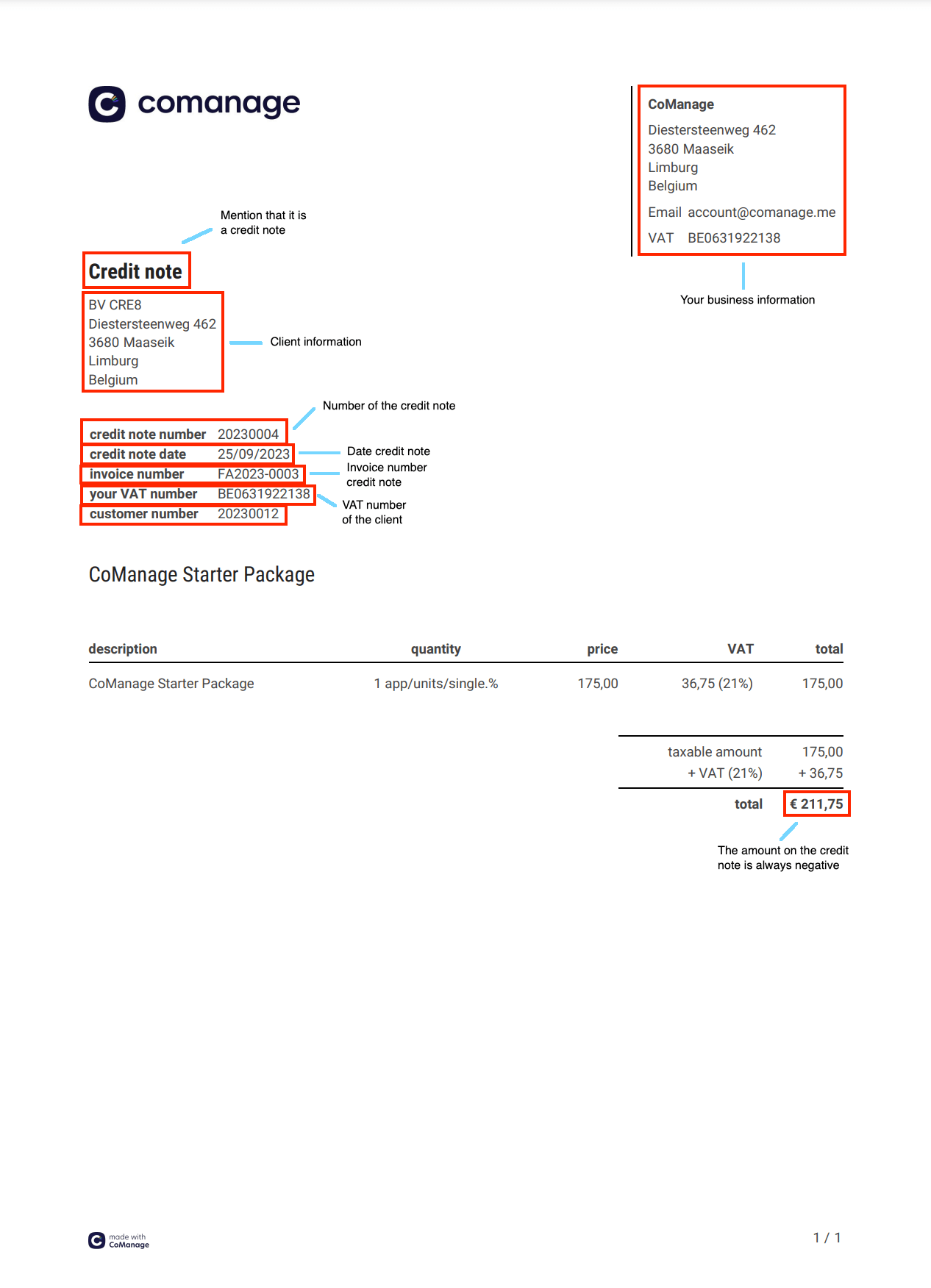

Example of a credit note

You can read the detailed explanation of what should be on a credit note below.

What should be included on a credit memo?

A credit memo contains (just about) all the elements you must include on an invoice, but in addition, there are a few specifics you must include.

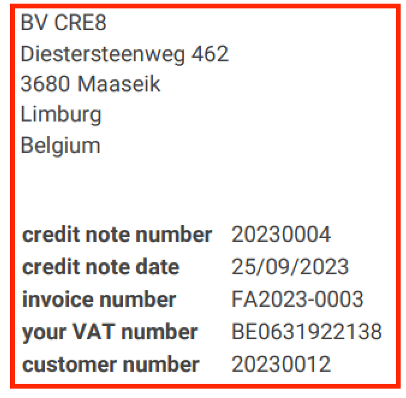

Statement "credit note."

Instead of "invoice," you should clearly state that the document is a "credit note."

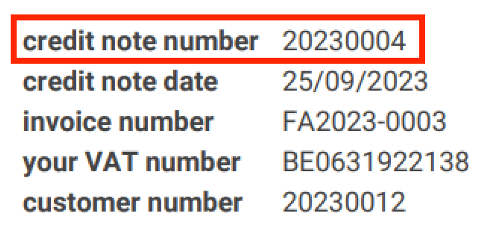

Numbering credit memo

Just like an invoice, a credit memo must be numbered. This simply follows the numbering of your invoices.

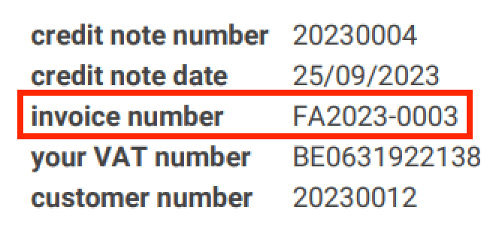

Invoice number to which the credit note relates

You must clearly state to which invoice your credit note is linked. Use the number of the original invoice for this purpose.

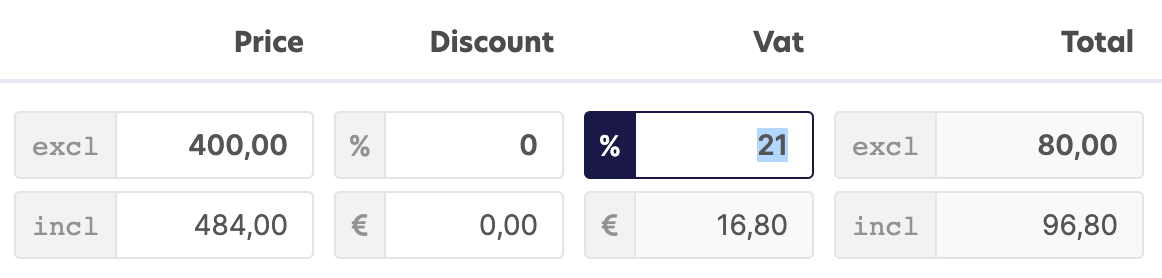

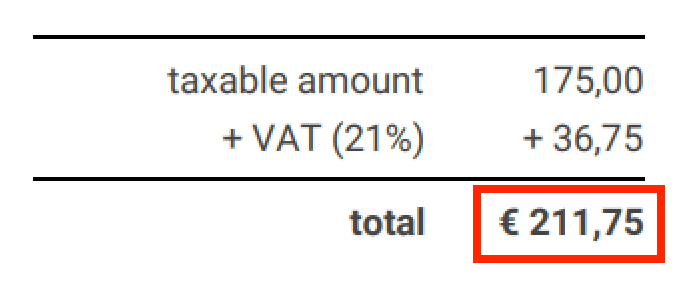

Invoice amount

This amount must correspond to the amount stated on the original invoice. The amount on a credit note is always negative. This is because your customer does not have to pay this to you and you do not have to pay it to your customer. You are not required to put a minus sign in front of it, but you can. Both are correct.

Credit note date

You must also include a credit note date. Since your customer does not have to pay, a due date is meaningless. So you omit this one.

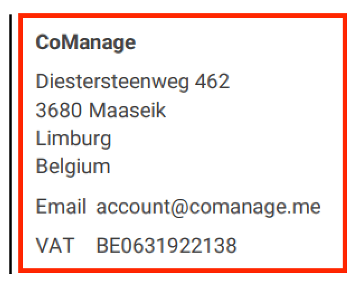

Your company information

Name of your company

Address of your registered office

Your VAT number

Details of your customer

Name

Address

For businesses: your customer's VAT number

When preparing a credit memo, you need to pay attention to quite a few details.

Remember that this is your chance to correct a wrong invoice. It is therefore super important that you do not make any mistakes on your credit note.

Fortunately, in practice this is not that difficult.

How can you create a credit memo?

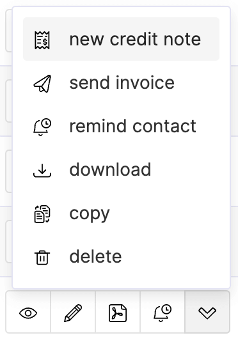

How you create a credit invoice depends mainly on your invoicing program. In CoManage, for example, you can create a credit note in 3 steps.

Step 1: Open the invoice for which you want to create a credit note

Step 2: Click on "Actions" and choose "Credit note".

Your credit note is ready.

Step 3: Send your credit note

You can either download your credit memo and send it by e-mail, or directly in CoManage. Be sure not to forget to provide your credit memo to your accountant as well.

It's that easy to create a credit memo. Once you've done this, the following happens automatically:

The total amount of unpaid invoices is adjusted.

Your next invoice gets a correct, consecutive invoice number.

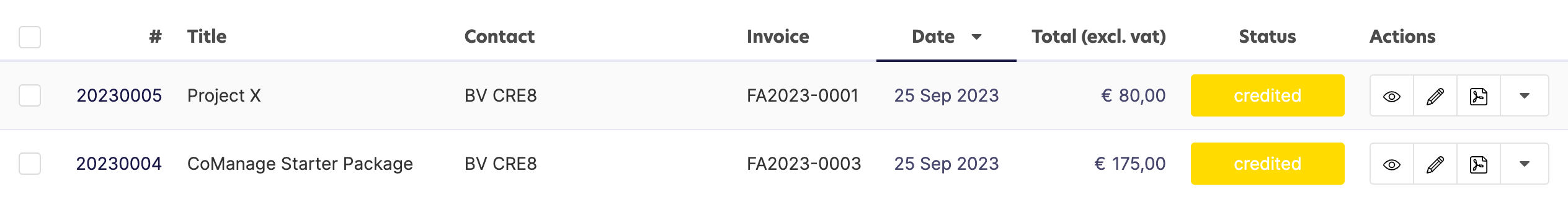

Your credit note can be found in a separate, convenient overview.