Reminder Email for Payment - 4 Templates + Tips

A good reminder email for payment requires more than writing skills. These 4 email templates and extra tips will increase your chances of collecting overdue payments quickly.

Table of contents

Friendly payment reminder email template

This email is brief and ideal to send when the due invoice date is overdue.

Possible email subject lines:

Friendly reminder: invoice XXXX.

This is by far the most neutral subject line for payment reminders. It is riskless, but also dull.

Friendly reminder

This can invoke curiosity. It might be a reminder of an event or a question the customer did not answer. Only, it is not. The effect of surprise can work here.

Email body:

Dear <Contact Name>,

I understand that my mail from <due date> may have slipped your attention.

Therefore, I would like to remind you of the invoice in the attachment. You can find the payment instructions on it.

If you have any issues or questions, you can simply reply to this mail and I am sure we will find a solution.

In case you have already made the payment, please disregard this reminder.

Again, thank you for your valued trust in <Your Company>.

Best regards,

<Your Name>

Attached: Invoice <Invoice number>

Footer email

Use case for this reminder email

This is a rather generic email and therefore fit for all sorts of businesses that want to remind customers of overdue payments.

When to (not) send this email?

The best timing to send this email is as quickly as possible after the due payment date.

Obviously, do not send this before the payment deadline has passed. Further down, you can find a template for this situation.

Why does this email work so well?

There are a couple of reasons this email template works. If you adapt the sample to your needs, make sure your reminder email contains the following elements.

Friendly tone. You want to keep it as friendly as possible in your first reminder.

You understand that communication errors can happen. By keeping it vague and not blaming the recipient or technology, nobody will feel hurt or attacked.

The invoice is attached. And you mention this twice, making it hard for people to miss this. At the same time, you make it easy for them to find the document you are referring to.

Although all should be clear, people may have troubles of any kind, and you are offering help. Think, for instance, of a temporarily blocked bank account, a stolen card, a hacked computer, an illness, etc.

You end the mail with “Thank you”. These are two powerful words in business and life.

Sending your customer a reminder when the invoice is overdue is not your only option…

Payment reminder email before the due date

Some businesses prefer a proactive approach. If this sounds like you, the following email template will come in handy.

Email subject lines:

Your invoice is almost due

Reminder: you have an outstanding invoice

Email body:

Dear <Contact Name>,

I would like to remind you that on <due date>, the invoice with the reference <invoice number> will expire.

We hate charging additional administrative fees for late payments, and that’s why I took the liberty to email you.

You can find the payment details in the attachment. Please let me know if you have any further questions. You can reach me by hitting reply to this email.

In case you have already planned to make the payment, please disregard my message.

Thank you again for your valued trust in <Your Company>.

Best regards,

<Your Name>

Attached: Invoice <Invoice number>

Footer email

Use case for this payment reminder email

This email is important if you charge additional fees for overdue invoices. But even when you do not apply this systematically, you can send a reminder to customers before they are supposed to pay you.

When to best (not) send this reminder?

Do not send this mail when your customer has paid you. Further down, you can discover how easy this can be without checking your bank account every day.

The ideal timing is 3 to 7 days before the due payment date. This gives your customer enough time to act.

Why is this a good reminder email?

The true power of this email is that you remind people before it is too late. Businesses and consumers are busy. A friendly reminder is a way to help them organise. Other than that, this email template has more advantages for you.

The pressure you put on people to pay in due time is subtle. When you mention additional fees for late payments, you give a warning of the consequences of paying late. In this example, you mention you would hate doing it. The customer may thank you for this with a swift payment.

You can only assume what the other party has planned. It won’t harm you to mention explicitly the possibility that they have already planned the payment.

Attaching the invoice is a sign of customer friendliness. Instead of forcing them to look up the invoice in their archives, you offer it on a silver plate.

Besides experimenting with the time to send a reminder, you can also try out an original style…

Sample of a witty payment reminder email

Running a business is not a joke, but that doesn’t mean you need to be formal. Even with payment reminders, you can keep the tone light. Instead of making people feel bad or guilty, you can make them feel good.

Subject email:

Did somebody forget something?

My boss is bothering me

I hate to send this

Body email:

Hi <Contact Name>,

My boss called me and told me to remind you that your invoice <invoice number> is due. So here I am, against my will.

I want to keep my boss happy, and between you and me, he is a great guy. He was the one who ensured we delivered your <project / goods> in due time. As you let us know, you were happy with it too.

So, I would like to ask for a favour in return (and stop my boss bothering me, because I am facing another deadline).

You can click here: <payment link> to open a payment link and transfer <invoice total > to our account.

If you've already paid, just let me know and I will tell my boss to be more patient in the future.

Have a nice day!

<Your Name>

Footer email

Use case for funny payment reminders

It is a bold move to use humour in emails. But it can do the trick to get people to pay your overdue invoice faster.

When to best (not) send funny payment reminders?

Don’t send witty payment reminders when customers don’t know you well, or when you have shown no sign of being funny before.

When you often make jokes, this is a great way to strengthen your business relationship even more.

Sarcasm is risky. This can be easily misinterpreted as an accusation.

If you do this as an employee, double check with your boss or manager first.

Can humour work in a payment reminder email?

The email is more of a sample than a template where you need to fill in the blanks. There are, however, some advantages of using a light style.

Humour makes writing payment reminders more fun for you.

A smile can do miracles. If you can make a customer chuckle while paying you, you did a wonderful job.

Let’s have a look at a completely opposite approach.

Formal second payment reminder email

Some people need to be addressed formally before they act. If you have tried a friendly reminder and that did not result in a payment, you can switch your style.

Subject line email: Second reminder: overdue invoice

Body email:

To whom it may concern,

It has come to our attention that, despite our previous reminder on <date first reminder>, the invoice <invoice number> has not been paid yet.

We strongly urge you to take immediate action and transfer the <invoice amount> to our company account.

We would like to bring to your attention that failure to fulfil your part of our agreement may result in additional fees and penalties. To avoid further complications, we kindly request to resolve this matter as soon as possible.

Please do not hesitate to contact us if you have any questions or concerns about your invoice. Our team would be happy to assist you in resolving any issues.

We appreciate your prompt attention to this matter and look forward to receiving your payment in the next few days.

Sincerely,

<Your Name>

Email footer

Use case for formal payment reminders

An official and formal payment reminder differs from one that is composed by a collection agency or lawyer. If this email template remains ignored, we strongly advise you to hire a professional to contact your client directly.

When to send a formal payment reminder?

Although you can use a formal style in your first payment reminder, it is most likely not your best choice. But there are always exceptions.

If your company has a zero tolerance for late payments, a formal payment reminder is a logical way of communicating your concerns.

If a friendly reminder or any of the other templates above does not work, you can use a more formal style in your second reminder.

What are the (dis)advantages of using a formal style?

Official sounding language creates a distance between you and the customer. A conflict happened (late payment) and as a company you leave no doubt that you are a legal entity with the right to get paid.

Here are some things to take into consideration when using this style.

Creating distance is not a synonym for being rude. In all cases, show respect by using words such as ‘kindly”, “please”, “appreciate”.

“To whom it may concern” only makes sense if you genuinely do not know who is taking care of the invoices you send. If your client asked you to send it to a generic email address (e.g. invoices@, accountancy@) this is your best possible way to show that you genuinely do not know whom you need to address.

The subject line clearly states that this is a second reminder of an invoice. In contrast to the friendly reminder where you can try to make them curious about the topic of your mail, you need to be clear what this mail is about.

Instead of using the first person, you write the email on behalf of the company. “We” makes more sense than “I”. “We” is also a clear sign that there are more people supporting the invoice reminder.

Now you hopefully have some good blueprints for your reminder email.

But you are not there yet. There are more tricks up your sleeve to get that invoice paid, fast.

A successful email payment reminder is more than body text

As the email templates above make clear, there are many details you need to pay attention to, to get… the attention of the email recipient.

Just like we did for email templates to remind people of your quotation, we want to highlight some crucial aspects that can bring you closer to your goal of getting your invoice paid.

Email sender

Send your payment reminder from the same address as you sent your invoice. This will make it much easier to prevent the spam box. The recipient recognises your email and this will increase the open rate of your email reminder.

Never send your payment reminder from a non-existing email address, or an email that is never opened, such as noreply@... People may want to respond to your reminder and the last thing you want is to close the door for further communication about overdue invoices.

If you are a freelancer, or own an SMB, the best option is to use an email address of a person and not a generic mail, such as info@, contact@, sales@, or invoicing@. There is really no point in separating your invoice communication from the people who worked for it.

Subject line

A proper subject line makes the difference between opening and ignoring your email in the never-ending flood of communication.

Here are some additional tips for a good subject line for emails to remind people of their outstanding invoices:

Avoid emojis, unless it fits with your typical style. Mail providers may send your mail directly to the spam folder.

Keep the subject line short.

It is best practice to make clear what your mail is about. But you can even use humour, or trigger the curiosity of people by only giving a clue what your mail is about.

Examples of good subject lines for email payment reminders

Besides the generic and no-risk subject line of the email templates, you can try these subject lines in your payment reminders.

Oops

Somebody made a mistake. It happens all the time. Chances are your client won’t think it was them and they want to find out what happened.

Time flies…

This subject line also invokes curiosity. It is a safe bridge to the body of your email where you tell that you understand the customer forgot to pay your invoice.

Examples of bad subject lines for email payment reminders

Unfortunately, it is way too easy to undo the success of payment reminders. A bad subject line can lead to not even opening your mail, or worse: anger.

Your Invoice Is Unpaid

This one is a bit on the edge of good and bad. The most horrible thing about this subject line is the use of the so-called title case. You know when every word gets a capital letter. Nobody writes mails like this.

YOUR INVOICE IS UNPAID!

Besides the exclamation point, a subject line in full capital letters shows anger. Even if you would use a more gentle expression, capital letters are a sign of aggression. Or spam. This is not the impression you want to give in any business email.

Do you need more time to pay?

Although this is a gentle offer, it’s not doing your business a favour. If you are spontaneously offering people to pay later, you can expect that somebody will abuse this. Even if your customer has paid, this may plant a seed in their heads that will grow by the time you send your next invoice.

Adapt your payment reminder emails to your business

As with any business communication, there is not only one way to get payment reminders right or wrong. The success of your payment reminders also depends on how good you are at taking the broader context into account.

What is your type of business? Are you a faceless enterprise or a highly personalised SMB or freelancer where customers actually know you?

How is your business relationship with the customer? Do you have a history together? Or is it the first time you are doing business?

What is your brand voice? Friendly, neutral or formal?

Who deals with unpaid invoices? You (as a freelancer or business owner) or your accountancy staff?

Do you have strict business policies and procedures, or do you go through the day extinguishing fires?

As you can understand, all these aspects can impact both the texts of your email, and the timing and way you send reminders.

If you are dealing regularly with overdue invoices, we highly recommend you read our article about the best practices for payment reminders. You will learn some techniques and surprising strategies that can do two things for your business:

Decrease the amount of payment email reminders you need to send out.

Get paid within 3 weeks after you have sent your invoice. That's not a fictional promise, but based on a customer survey at the end of 2022.

How to easily send a payment reminder email template?

It’s not smart to send out an email template before tweaking it a bit. Your chances to get paid increase when you personalise the templates above.

Depending on the way you actually send the reminder, this can vary from seconds to even half an hour per email.

Let’s look, for instance, at how you can do this in CoManage.

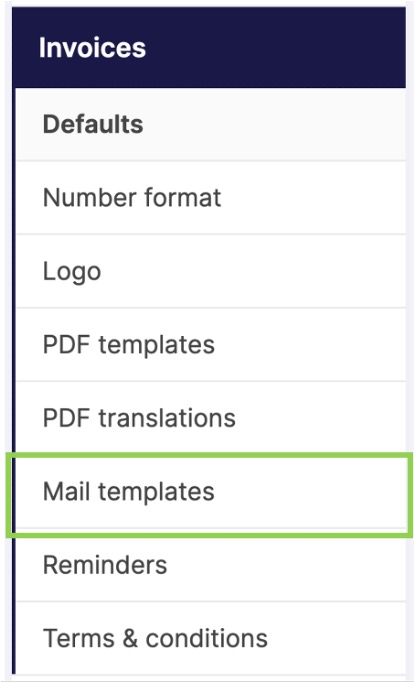

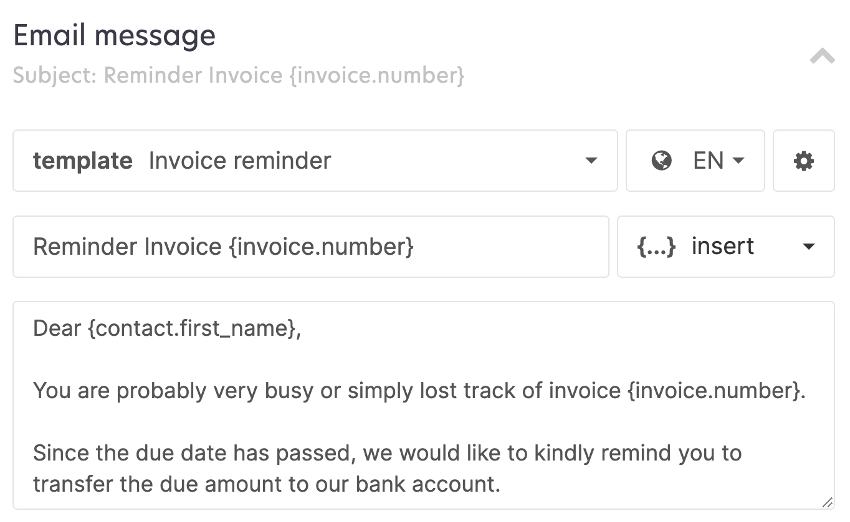

How to set up a payment reminder email template?

The first thing you need to do is to either create an email template from scratch, or adapt the default email payment reminder template.

We started an integration with Chat-GPT in CoManage and therefore it is possible to ask AI to help you to write your reminder emails. This can help you to write a personalised email.

You can find this under the settings of your invoice.

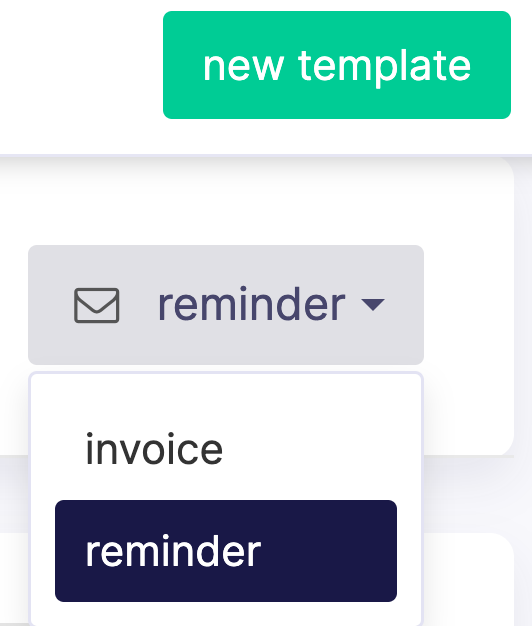

Then you choose Reminder as and click on New template.

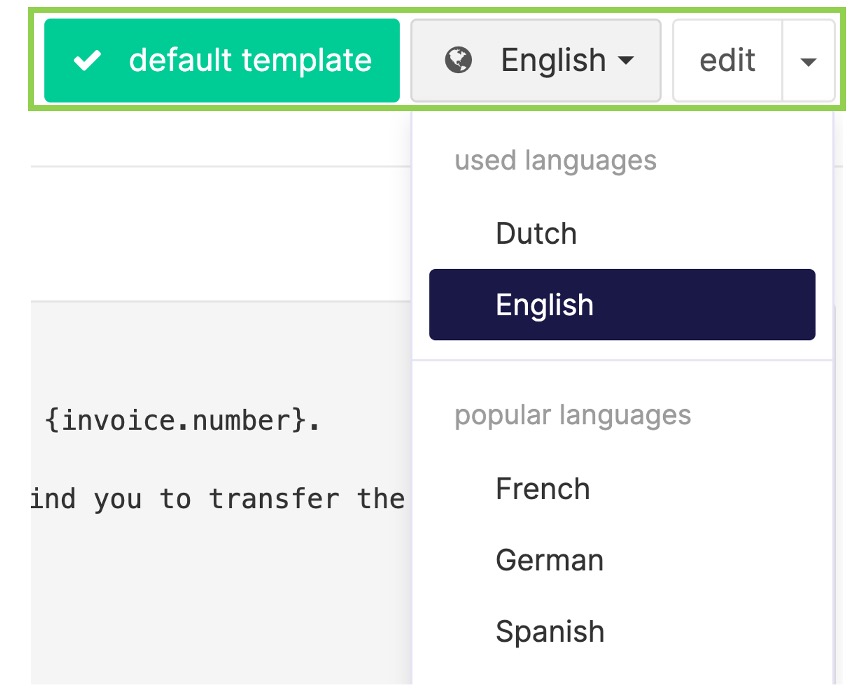

If you send invoices in different languages, you can also enter a translation of your payment reminder.

How to send the payment reminder with a click?

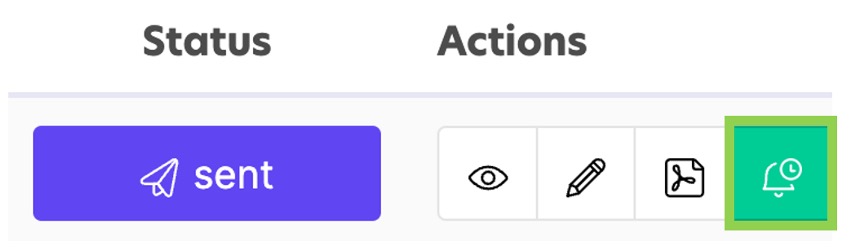

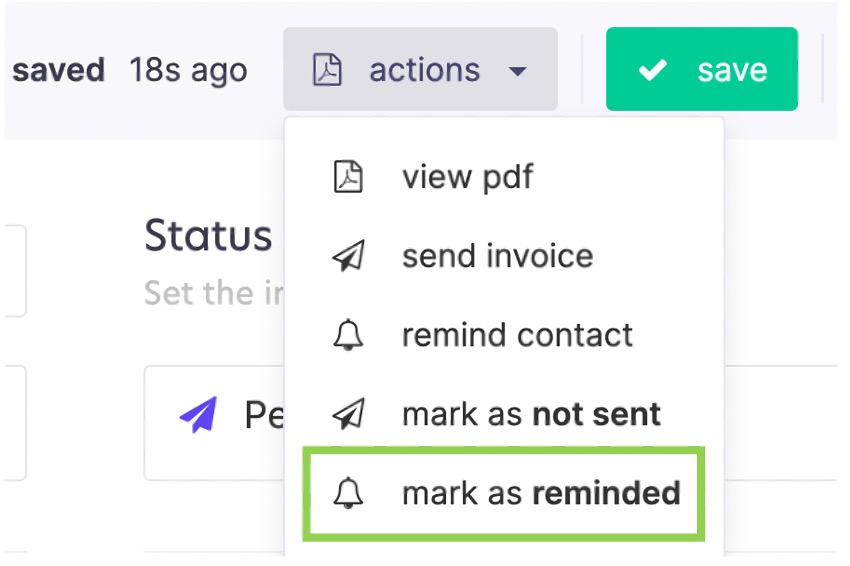

To email reminding customers of your invoice, you go to the overview of your invoices.

Click on the bell icon next to an invoice.

You can also change the status of an invoice manually into “Reminded”. This way, you, or your team members, will never send a payment reminder twice.

How to automatically send payment reminder emails?

Instead of sending payment email reminders manually, you can also have them sent out automatically.

If you don’t like taking the risk that your customer has paid the invoice before you sent the mail, make sure you include this line in your email:

If you have already made the payment, please disregard this reminder.

Another way is to link your invoicing program to your bank account. You can use a 3rd party tool that deals with this in a secure and automated way, such as Ponto, which works smoothly with CoManage. This helps you save additional time with your invoice administration.

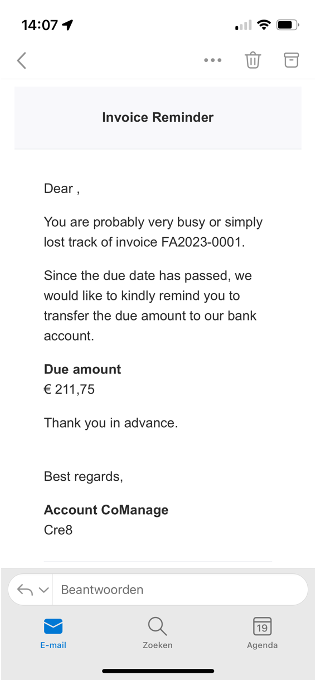

The final result looks like something like this.

Of course, your clients will see your reminder message.

One more nice thing is that even if you use a template, you can change the mail before sending it out. Again, here it is a tip to make use of the Ask AI button to help you write the text!

Final note

We get it. You urgently want to send that reminder email now and move on with your day. We sincerely hope that the payment reminder templates and additional advice will help you achieve this.

However, if you have 10 spare seconds, you can click on the button below and fill in your email address. This will start your free trial of our powerful solution for freelancers and SMBs to easily manage everything related to invoicing.